Leveraging AI Technology for Risk Management

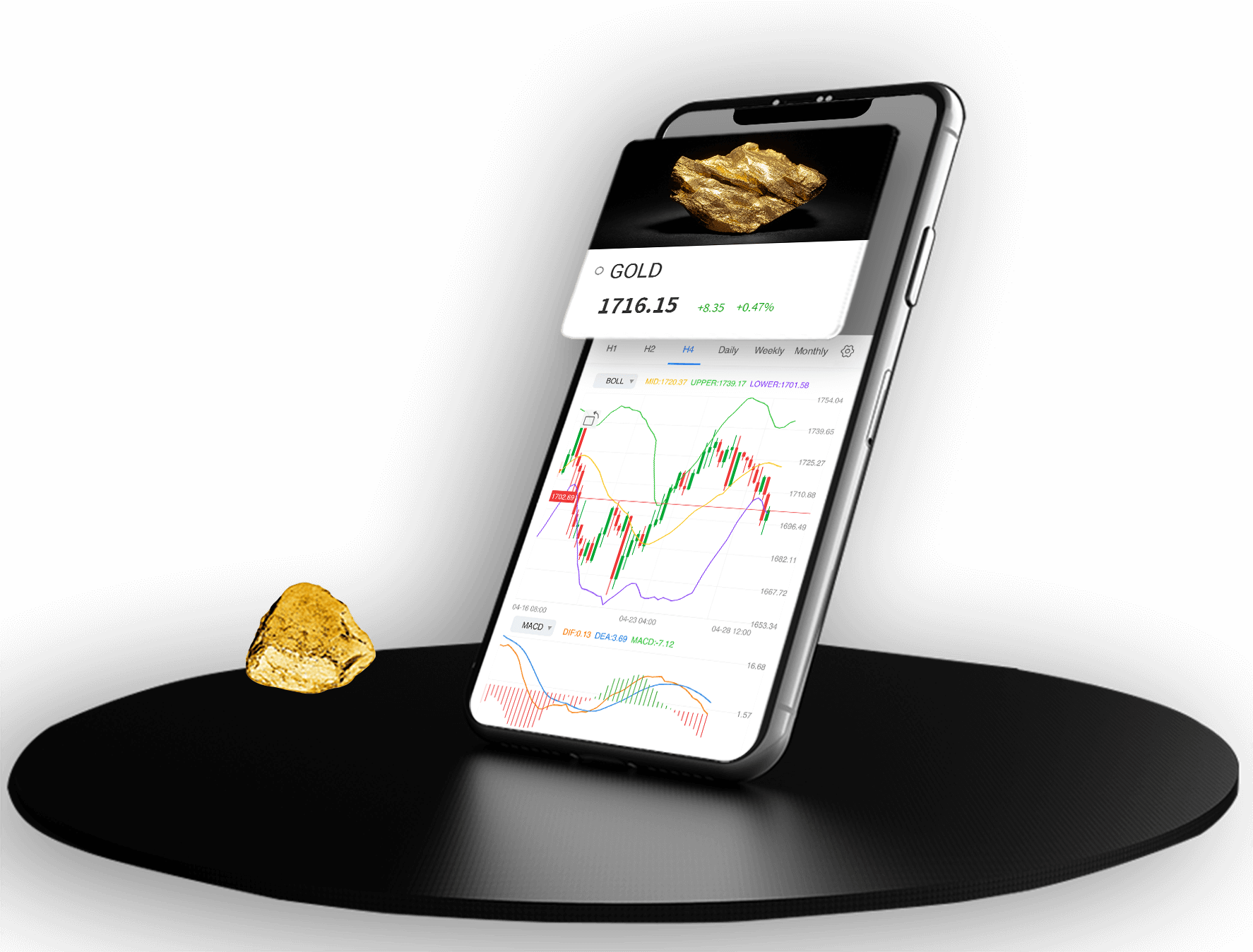

Our AI-driven platform combines the power of machine learning algorithms and real-time market analysis to provide you with comprehensive risk management solutions. By leveraging the capabilities of AI, we enable you to set stop loss and take profit orders that automatically execute trades based on predefined price levels. AI Trading

buy crypto and investStop Loss Orders: Setting Boundaries

A stop loss order is a risk management tool that helps limit potential losses by automatically selling a security when it reaches a specified price level. By setting a stop loss order, you establish a predetermined exit point for your investment, protecting yourself from excessive losses in the event of adverse market movements. Our AI algorithms continuously monitor market conditions and execute stop loss orders swiftly and accurately, ensuring that your downside risk is effectively managed.

Take Profit Orders: Securing Profits

Take profit orders are designed to secure profits by automatically selling a security when it reaches a predetermined price target. By setting a take profit order, you can lock in gains and capitalize on favorable market movements. Our AI-powered platform allows you to set take profit orders based on your investment goals and risk appetite, providing you with the flexibility to optimize your returns. AI Trading

Integrating AI technology into risk management offers several key advantages:

- Speed and Efficiency

- Data-Driven Decision Making

- Emotional Bias Elimination

- Customization and Flexibility

- Continuous Learning